Discover Forex, Stocks and Crypto trading signals with 79% to 89% accuracy

If you want to receive trading signals - like these in real time - register on the platform and buy the Pro version of LargeTrader.

Kellogg Co - K trading signal

US stock price signals and analysis

Good morning Traders,

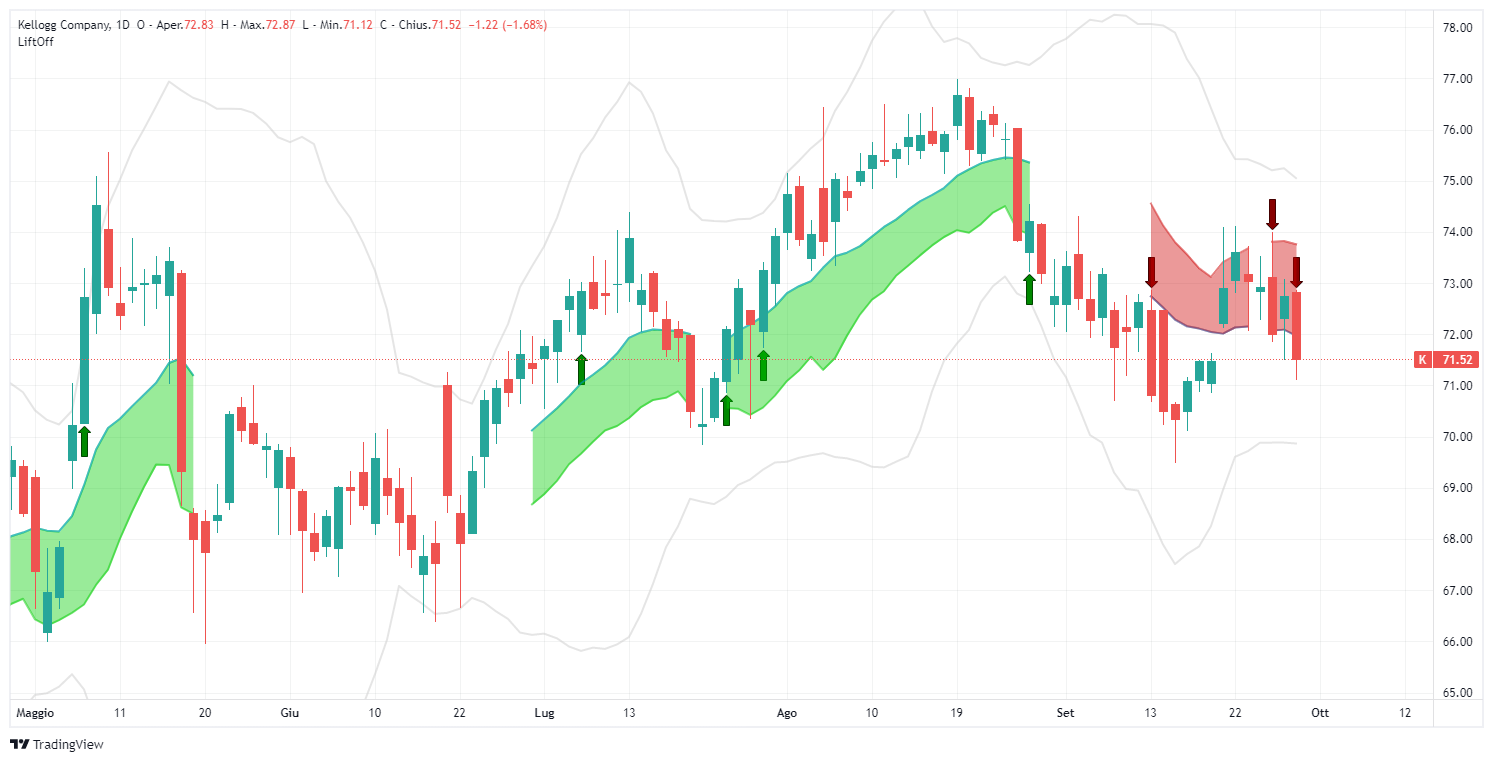

Today, September 30, Lift-Off offers a SHORT trading signal on the US stock Kellogg Co (Ticker: K) listed on the NYSE and part of the S&P500 index.

Yesterday it closed at $71.52 per share, marking a -1.68% in closing session

The company operates in the "Consumer Non-Durable Goods" sector specifically in the "Food: Confectionery/Specialty"

The company has low financial robustness, e.g. Cash-To-Debt of 0.04, but maintains a still good WACC vs. ROIC. Growth is estimated to be "slight" for the next few years

In the last few quarters it manages to maintain rising revenues, declining net profits, slightly declining debt, and declining free cash.

Next earnings announcement for Q3 2022: November 3, 2022

Below chart of Kellogg Co - K- with signal detected by Lift-Off

Some information about Kellogg Co

Kellogg Co. engages in the production, marketing and distribution of cereals and ready-to-eat foods.

The company markets cookies, crackers, chips, and other convenience foods, under brands such as Kellogg's, Cheez-It, Pringles, and Austin, to supermarkets in the United States and also in: Europe, Latin America, and AMEA (Asia Middle East Africa).

The company was founded by Will Keith Kellogg in 1906 and is headquartered in Battle Creek, MI.

Financial Overview: K's current market capitalization is USD 24.74B. The company's TTM EPS is USD 4.37, dividend yield is 3.24% and PE is 16.76. Kellogg Company's next earnings release date is November 3. The estimate is $0.97 USD.

Accounts, including sales, expenses, profit and loss:K's total sales for the latest quarter is $3.86B USD, up 5.23% from the previous quarter. Net income in Q2 22 is $326.00M USD.

Overview data and accounts source: Tradingview.com

Signal Chart September 30, 2022

SHORT - Kellogg Co - K

Input price: $71.52 (and any opening price)