Discover Forex, Stocks and Crypto trading signals with 79% to 89% accuracy

If you want to receive trading signals - like these in real time - register on the platform and buy the Pro version of LargeTrader.

Comerica Inc - CMA trading signal

US Stock Price Signals and Analysis

Good Morning Traders,

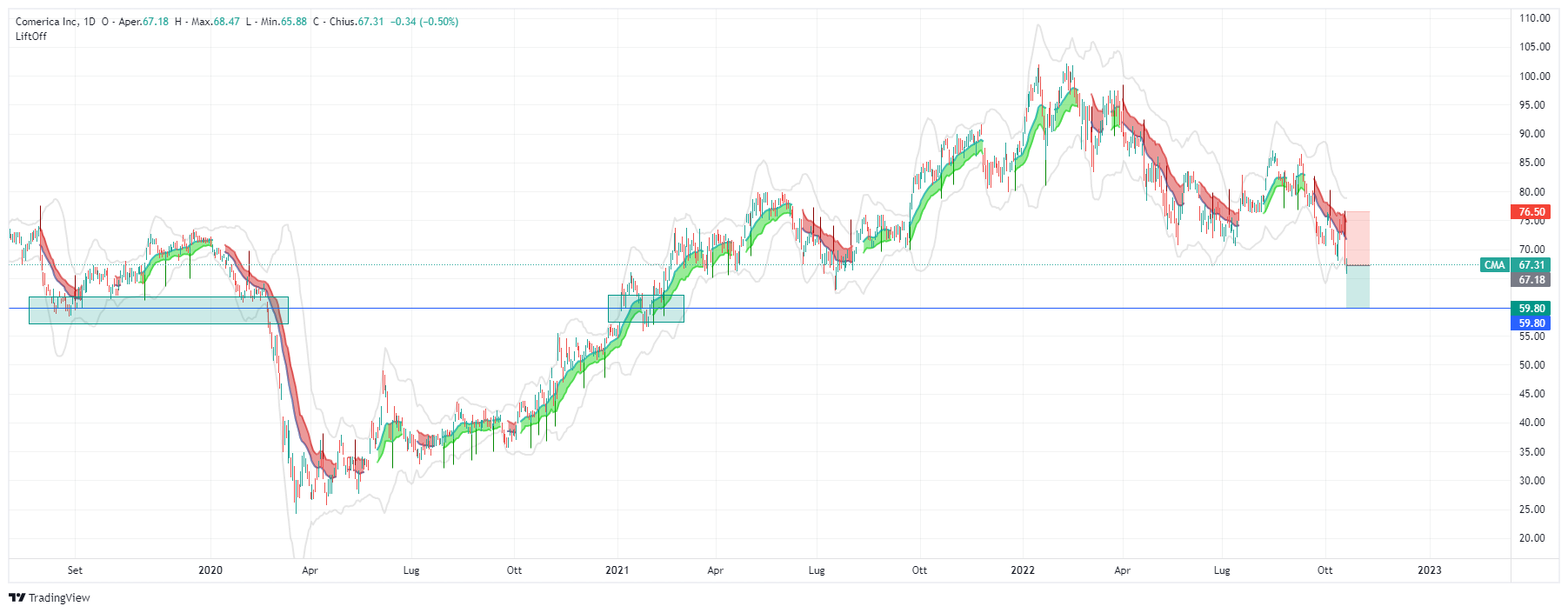

With the close of October 19, Lift-Off offers a SHORT trading signal on the US stock Comerica Inc (Ticker: CMA) listed on the NYSE and part of the S&P500 Index.

The stock closed at $67.65 per share, marking -9.00%.

The company is operating in the "Finance" sector particularly in the "Major Banks Industry"

Financial robustness figures are low, Cash-To-Debt figure is good at 2.86 (so the company can repay its debts), WACC vs ROIC is zero as no ROIC is detected. Financial stress indicators are average, thus negative.

The profitability level data is sufficient and the 10-year forecast is very good.

The future projection is seen to be slightly upward.

At this time, the price is slightly undervalued compared to the intrinsic value attributed to it, and it has a PE Ratio of 9.93.

Year-over-year sales are declining, while net income in 2020 was worse than 2019, but in 2021 the reading was upward.

Decreasing year-over-year debt and sharply increasing liquidity from 2020 year-over-year, but declining in the latest quarterly readings.

Next earnings announcement for Q3 2022: October 19, 2022 reported them at open markets

EPS: Reported 2.6 / Expected 2.57 / change+0.98%

Earnings: Reported 985.00M / Forecast 964.02M / change +2.18%

Below chart of Comerica Inc - CMA - with signal detected by Lift-Off

Below chart of Comerica Inc - CMA - with target level and past zones

Some information Comerica Inc

Comerica Inc engages in the provision of financial services.

It is engaged in meeting the needs of small and medium-sized market enterprises, multinational corporations, and government agencies by offering various products and services, including commercial loans and lines of credit, deposits, liquidity management, capital market products, international trade financing, letters of credit, foreign exchange management services, and loan syndication services.The Retail Bank segment includes small business banking and personal financial services, consisting of consumer loans, consumer deposit taking and mortgage loan collection; Wealth Management offers trust services, private banking, pension services, investment management and advisory services, investment banking and brokerage services; the Finance sector consists of the company's securities portfolio and asset and liability management activities.

It also deals with the economic and liability impact of equity and cash, tax benefits, charges of an unusual or infrequent nature that do not reflect normal operations, and other miscellaneous expenses of a corporate nature.

The company was founded in 1973 and is headquartered in Dallas, Texas.

Financial Overview: CMA's current market capitalization is $9,725B. Comerica Incorporated's next earnings release date is January 19. The estimate is US$2.67.

Accounts, including sales, expenses, profit and loss: CMA's total revenue for the latest quarter is US$985.00M, up 2.18% from the previous quarter. Net income in Q3 22 is -349.00M USD.

Overview data and accounts source: Tradingview.com

Signal board October 20, 2022

SHORT - Comerica Inc - CMA

Input price: $67.18 (and any opening price)

Price stop loss or adjustment zone: $76.50

Price take profit zone 1: $59.80

Price take profit zone 1: $59.80

.